Post by Mike

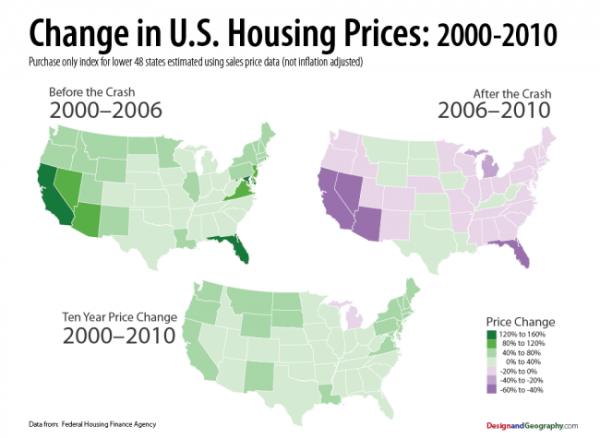

Conditions are right for a big swing in

the housing and real estate recovery, and here is hard data showing

we are sitting on top of a loaded spring.

Last week I suggested that inventories,

values and interest rates were at low levels. Today I found the

following charts. The first one is from the U.S. Treasury and

presented by the CFR. It shows how home prices have declined since

the end of the recession as compared to the other post war recovery

averages.

My theory is that the inventory was so

large (and lending so loose in the boom) that working the mess

through the pipeline had caused this deflation.

The next chart is from the St. Louis

Fed. It shows M2, or the money supply. Obviously, the FED has been

pushing money into the system. The only problem is it has not been

reaching the broader economy, as shown in the third chart which is

the velocity, or movement of money.

While the FED has been doing it's part,

the banking sector and corporate America appear to be sitting on

piles of cash. Also notice the low interest rates.

Like a compressed spring, the tension

is building in the system. At some point buyers are going to borrow,

banks are going to lend, and all that money on the sidelines will

spill into the market.

When that happens, you are going to see

the bull return to the real estate sector. Why real estate instead of

stocks? A few reasons - 1 - Wall Street has lost a lot of trust. 2 -

Real Estate is depressed. People like to buy low and sell high.

Get ready, the real estate market will

inflate again.